Budgeting isn’t exactly the most exciting task for a SaaS startup founder, but let’s face it—nailing your finances is critical if you want to scale.

Luckily, the days of wrestling with spreadsheets that break at the first formula error are over—introducing the wonderful world of budgeting tools! These tools are designed to save you time, eliminate mistakes, and give you the insights you need to grow.

However, not all tools are created equal. Some are perfect for early-stage startups, while others shine for enterprise-level planning, and more and more are being introduced each year.

When you're running a SaaS startup, every dollar counts. Here’s a detailed look at the five best budgeting tools for SaaS startups, based on their features, ease of use, and suitability for different business stages.

Let’s dive straight in.

Why SaaS startups need budgeting tools

As you know, SaaS startups operate in a dynamic, data-driven environment. That means managing recurring revenue, predicting churn, and allocating resources effectively requires precision and agility. Traditional spreadsheets just can’t keep up.

Modern budgeting tools go beyond number crunching—they automate workflows, provide real-time insights, and offer collaboration features that help teams make smarter decisions.

The right tool can be the difference between guessing your way forward and confidently navigating your next growth phase.

What to look for in a budgeting tool for SaaS startups

But what actually makes a budgeting tool a good fit for your SaaS startup? Here are a few key factors to consider:

- Integration: It should work seamlessly with your existing tools, like your CRM, ERP, and billing software.

- Scalability: Whether you’re a small startup or scaling fast, the tool should grow with you.

- Collaboration: Teams across departments should have easy access to financial insights without needing to dig through spreadsheets.

- SaaS-specific features: Look for tools that support your key metrics like monthly recurring revenue (MRR), annual recurring revenue (ARR), and churn forecasting.

- Ease of use: Your team shouldn’t need a finance degree to use it.

Now we’ve covered the basics, let’s explore our top five best budgeting tools for SaaS startups.

If you’re committed to spreadsheets but want automation, Cube or Vena are solid options.

For SaaS-specific tools with advanced forecasting, Drivetrain is purpose-built for your needs.

If collaboration and accessibility are priorities, Mosaic makes financial data a team-wide effort.

For scaling enterprises needing customization, Workday Adaptive Planning delivers robust capabilities.

1. Cube: Spreadsheet power with modern flexibility

For SaaS startups already deep into Excel or Google Sheets, Cube bridges the gap between manual spreadsheets and modern financial planning. It enhances what you’re familiar with—without forcing you to start over.

Key features

- Spreadsheet-native: Cube integrates directly with Excel and Google Sheets, so there’s no need for your team to learn to use new software.

- Automated consolidation: Instead of piecing together data manually, Cube pulls numbers in real time and keeps everything updated.

- Scenario planning: You can test multiple “what-if” scenarios—like adjusting pricing or customer acquisition costs—and see the financial impact instantly.

Who it’s best for

Small to mid-market SaaS startups that need robust financial planning without abandoning their existing spreadsheet workflows.

💡 Pro tip

Use Cube’s drill-down capabilities to trace every number back to its origin—no more guessing where your data came from when finance needs answers fast.

2. Mosaic: Financial planning as a team effort

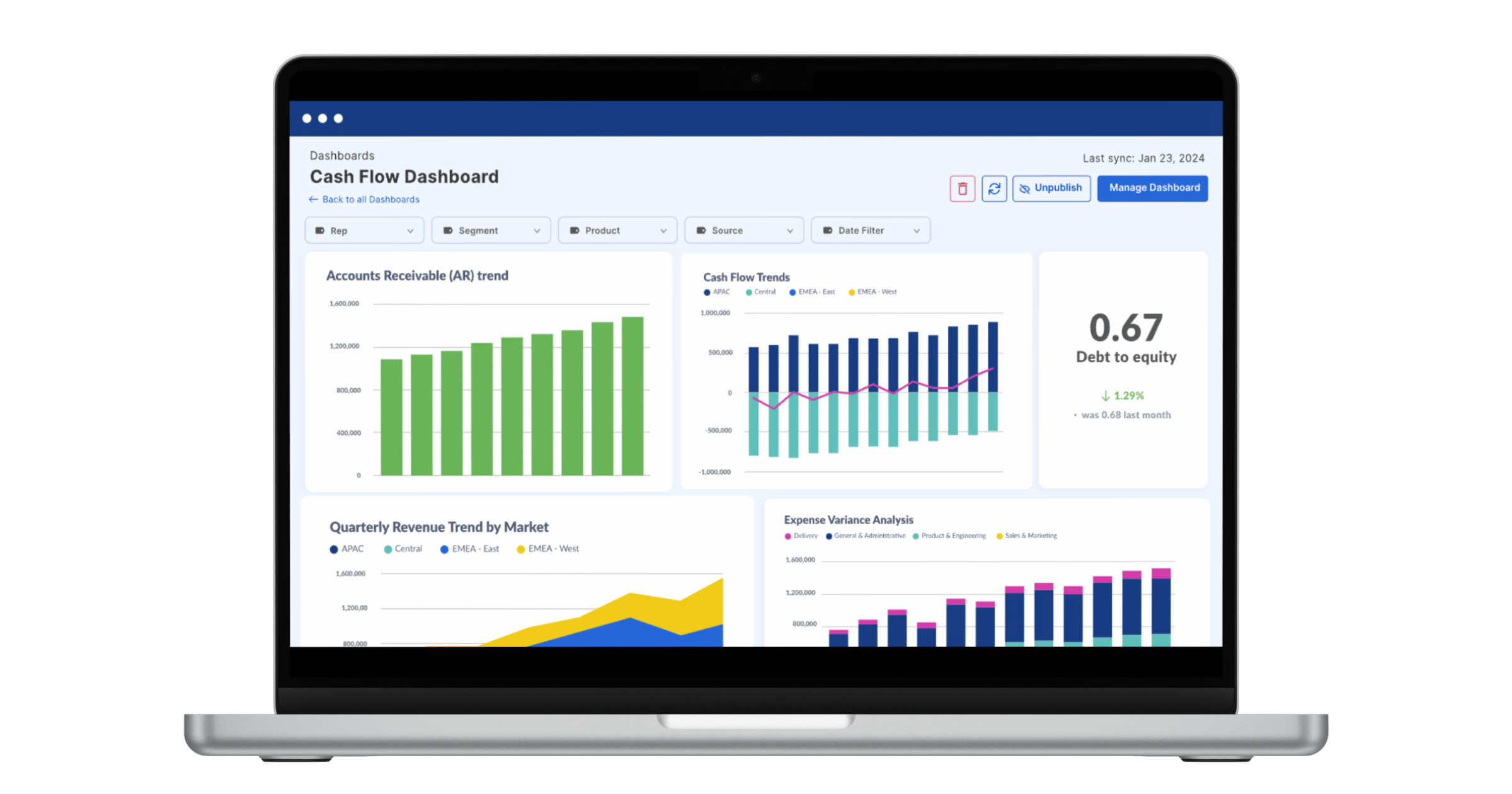

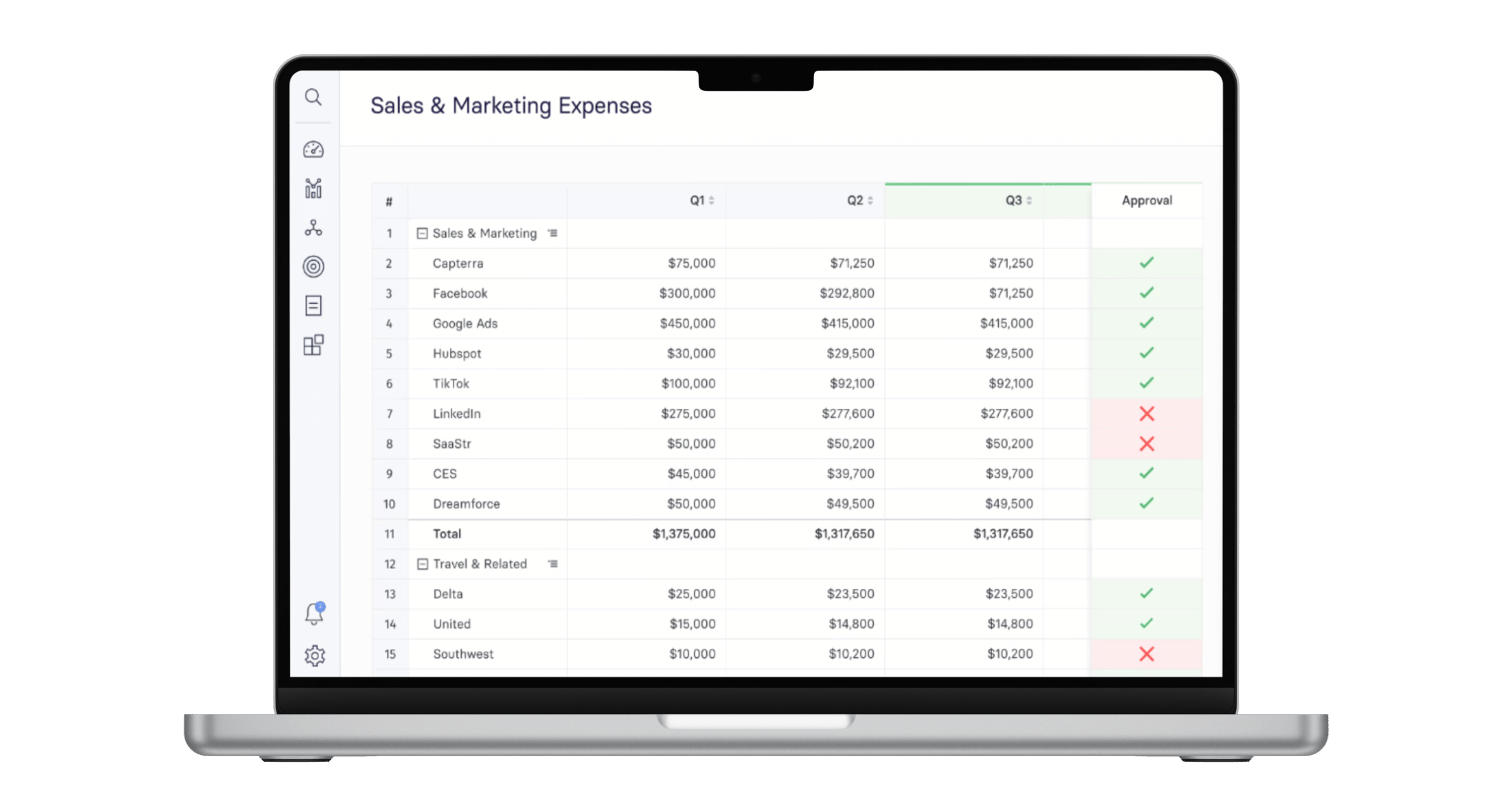

Mosaic simplifies budgeting and forecasting by making financial data accessible to everyone—not just the finance team. It's collaborative tools and intuitive dashboards are ideal for startups that value cross-functional input in their financial planning.

Key features

- Collaborative planning: Mosaic connects department heads with live financial data, allowing more informed decisions across teams.

- Intuitive dashboards: Visual reports make it easy to track metrics in a way everyone can understand.

- Flexible budgeting: Supports both top-down and bottom-up approaches that adapt as your startup grows.

Who it’s best for

Small to mid-sized SaaS startups looking to foster transparency and collaboration in financial planning, aligning their goals across teams.

💡 Pro tip

Seamlessly manage multi-currency operations. If your SaaS startup is growing globally, you can keep your financial planning streamlined and consistent across regions.

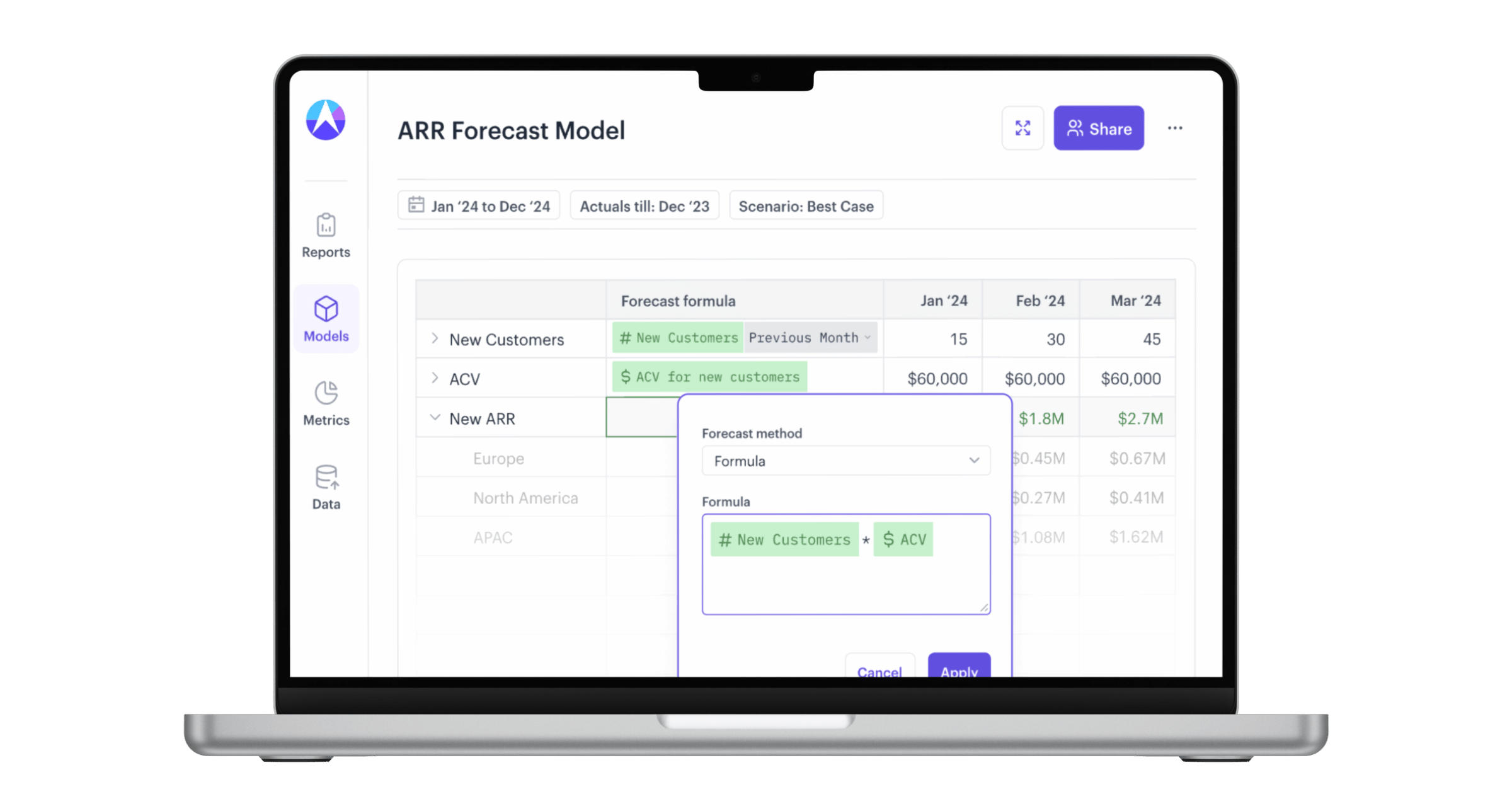

3. Drivetrain: Tailored for SaaS-specific financial challenges

Drivetrain is built specifically for SaaS businesses and subscription-based models, it handles complex forecasting, revenue modeling, and churn analysis with ease.

Key features

- SaaS-centric features: It’s designed for metrics like MRR/ARR, churn, and multi-currency reporting that are key for subscription-based businesses.

- Scenario planning: Ability to build predictive models to understand the financial impact of decisions like hiring, pricing changes, or entering new markets.

- Seamless integrations: With 200+ data connectors, Drivetrain brings together data from your whole tech stack.

Who it’s best for

Early-stage and mid-market SaaS startups looking for financial tools tailored to subscription models and rapid growth.

💡 Pro tip

Drivetrain’s strength is its focus on SaaS-specific forecasting. If you’re managing subscriptions, it’ll save you from building complex models from scratch.

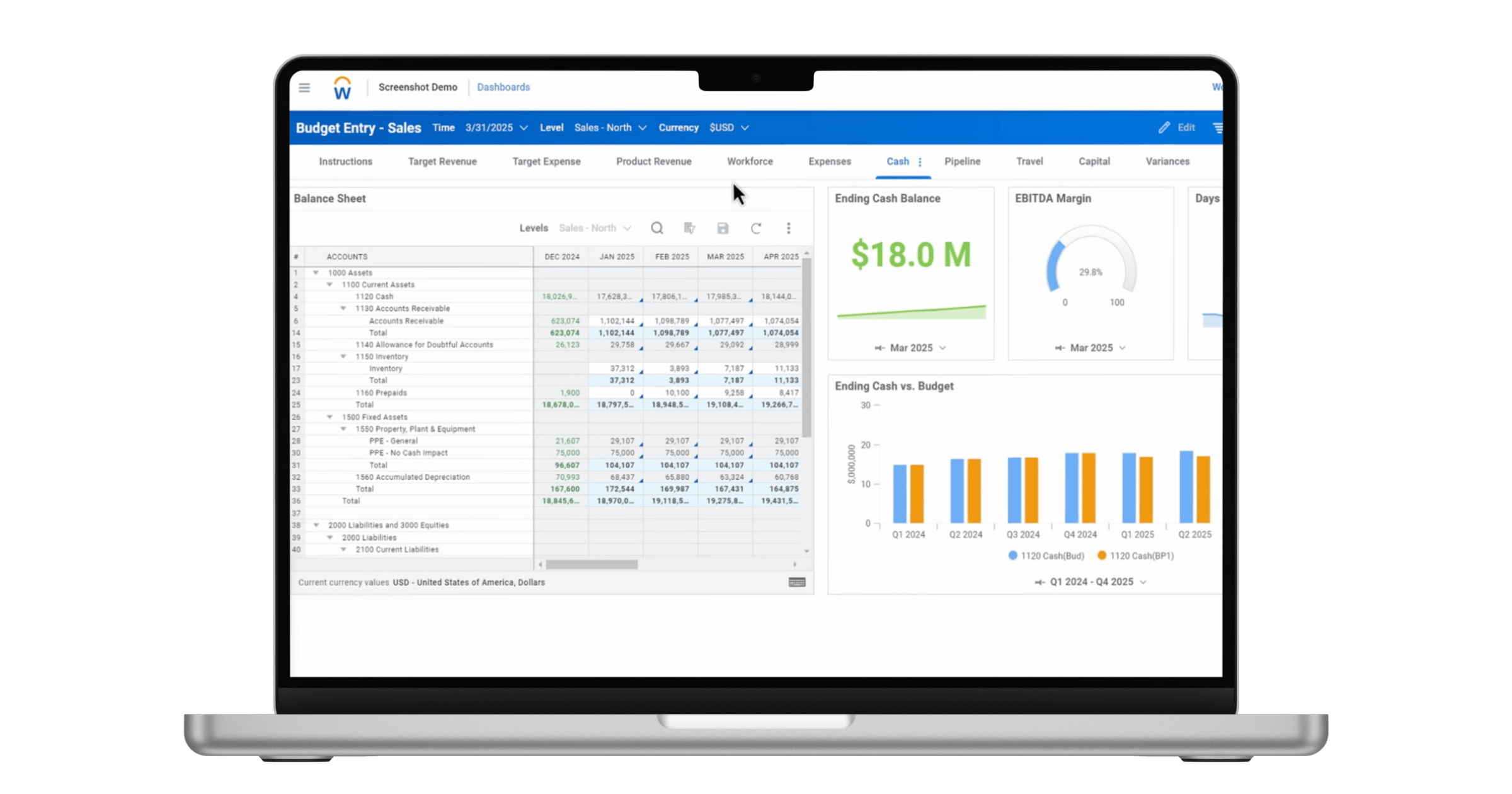

4. Workday Adaptive Planning: A scalable solution for growing startups

Workday Adaptive Planning is a strong choice for SaaS companies scaling into enterprise territory. It handles complex financial planning, forecasting, and reporting, all while offering more flexibility than traditional enterprise tools.

Key features

- Customizable planning: From driver-based budgeting to scenario modeling, it adapts to the needs of growing organizations.

- Scalability: It’s built to handle everything from single-office operations to multi-subsidiary global planning.

- User-friendly reporting: Compared to legacy enterprise tools, this tool is known for being easier to use and maintain.

Who it’s best for

Larger SaaS startups or enterprises that need detailed financial models, custom workflows, and robust reporting.

💡 Pro tip

Take advantage of Workday’s self-service dashboards to empower department leaders with financial insights directly, so they no longer need constant input from the finance team.

5. Vena Solutions: Excel familiarity with added automation

Vena Solutions takes the familiarity of Excel and layers it with automation, reporting, and collaboration features. For teams already invested in spreadsheets, it’s a natural upgrade.

Key features

- Excel interface: If your finance team already relies on Excel, Vena lets you keep that workflow while automating time-consuming tasks.

- Advanced reporting: Generate detailed financial reports and forecasts quickly, without worrying about broken formulas.

- Workflow automation: Vena reduces manual input with automated workflows and data consolidation, saving hours.

Who it’s best for

Medium to large SaaS startups that rely heavily on Excel but need to streamline budgeting and forecasting processes and improve accuracy.

💡 Pro tip

Use Vena’s scenario modeling to compare how different pricing strategies impact your MRR.

- Excel integration: You get all the functionality of Excel with added automation and reporting features.

- Advanced reporting: Create detailed, professional-grade financial reports in minutes.

- Automation: Eliminate manual processes with workflows that keep your data accurate and up-to-date.

How to choose the right tool

Choosing the right budgeting tool isn’t just about ticking boxes—it’s about finding a solution that aligns with your business’s unique needs. Here’s a quick comparison of some of our picks to give you a headstart:

As we’ve already mentioned, picking the right budgeting tool completely depends on your startup’s size, goals, and complexity. Here are a few extra tips to help guide your decision:

- Consider your stage: Early-stage startups may prioritize affordability and simplicity while scaling companies need advanced features like scenario modeling and integrations.

- Think about integrations: Make sure the tool works seamlessly with your existing tech stack—CRM, billing, and ERP systems.

- Look for SaaS-specific features: Subscription modeling, MRR/ARR tracking, and churn analysis are essential for SaaS businesses.

- Evaluate ease of use: Your team should be able to hit the ground running with minimal training.

Conclusion

Budgeting is a critical part of running a successful SaaS startup, but it doesn’t have to be a headache.

Tools like Cube, Mosaic, Drivetrain, Workday Adaptive Planning, and Vena Solutions can transform the way you manage your finances, giving you more time to focus on growth and innovation.

The best tool for you depends on your startup’s size, goals, and existing workflows. Explore these options, and pick the one that fits your needs—because the right budgeting tool isn’t just a nice-to-have; it’s a must-have for scaling your SaaS startup effectively.

FAQs

1. What are the benefits of using budgeting tools for SaaS startups?

When considering budgeting tools, it’s important to understand how they can address the specific challenges SaaS startups face. Here are some key benefits to keep in mind:

✅ Saving time: Automation eliminates repetitive tasks.

✅ Reducing errors: Say goodbye to broken formulas and version control issues.

✅ Improving collaboration: Intuitive dashboards make it easy for all stakeholders to contribute.

✅ Gaining insights: Real-time data and advanced analytics help you make smarter decisions.

2. How do budgeting tools help SaaS startups manage cash flow?

Cash flow management is one of the biggest challenges for SaaS startups, given the nature of the typical subscription-based revenue model. Budgeting tools tackle this by:

- Providing real-time insights: Tools like Float and Mosaic pull live data from your accounting systems, so you always know how much cash is coming in and going out.

- Forecasting future cash flow: They allow you to predict upcoming revenue and expenses, helping you spot potential shortfalls before they happen.

- Scenario modeling: By running “what-if” scenarios, you can prepare for best- and worst-case situations, like losing a big client or expanding your sales team.

- Automating reporting: Instead of wrestling with spreadsheets, you get clear, visual reports that show where your money is going and how to optimize it.

With these tools, SaaS startups can stay proactive, avoid cash crunches, and make smarter spending decisions.

3. What’s the difference between budgeting tools and FP&A tools for SaaS companies?

While budgeting tools and FP&A (financial planning and analysis) tools are closely related, they serve slightly different purposes:

Budgeting tools: These focus on creating, managing, and tracking budgets. They help businesses allocate resources effectively and monitor actual performance against planned goals.

FP&A tools: These take budgeting to the next level. They include advanced forecasting, financial modeling, and scenario planning to support strategic decision-making.

In short, budgeting tools are a core part of FP&A software, but FP&A tools offer a broader suite of features for financial planning. For SaaS startups, tools like Drivetrain and Workday Adaptive Planning offer FP&A capabilities, while tools like Cube or Vena focus more on budgeting with added automation.

4. How much do budgeting tools for SaaS startups typically cost?

The cost of budgeting tools varies based on features, company size, and the complexity of your needs. Here’s a rough breakdown:

- Entry-level tools: Lightweight solutions like Float often start at around $50-$100 per month, ideal for small SaaS startups.

- Mid-market solutions: Tools like Cube or Mosaic typically range from $500-$2,000 per month, offering more features, automation, and integrations for growing teams.

- Enterprise-level tools: Solutions like Workday Adaptive Planning or Vena are priced on a custom basis but can start at $10,000+ annually, depending on user count and complexity.

Most tools offer free demos, so it’s worth exploring pricing models and calculating ROI to find the best fit for your budget and goals.