My name is Sushma Zoellner, I’m the Co-Founder at Kultivation, a growth acceleration practice that helps companies and people grow their businesses and careers.

In this article, I’ll talk about the framework around career management my co-founder and I captured through our combined experience.

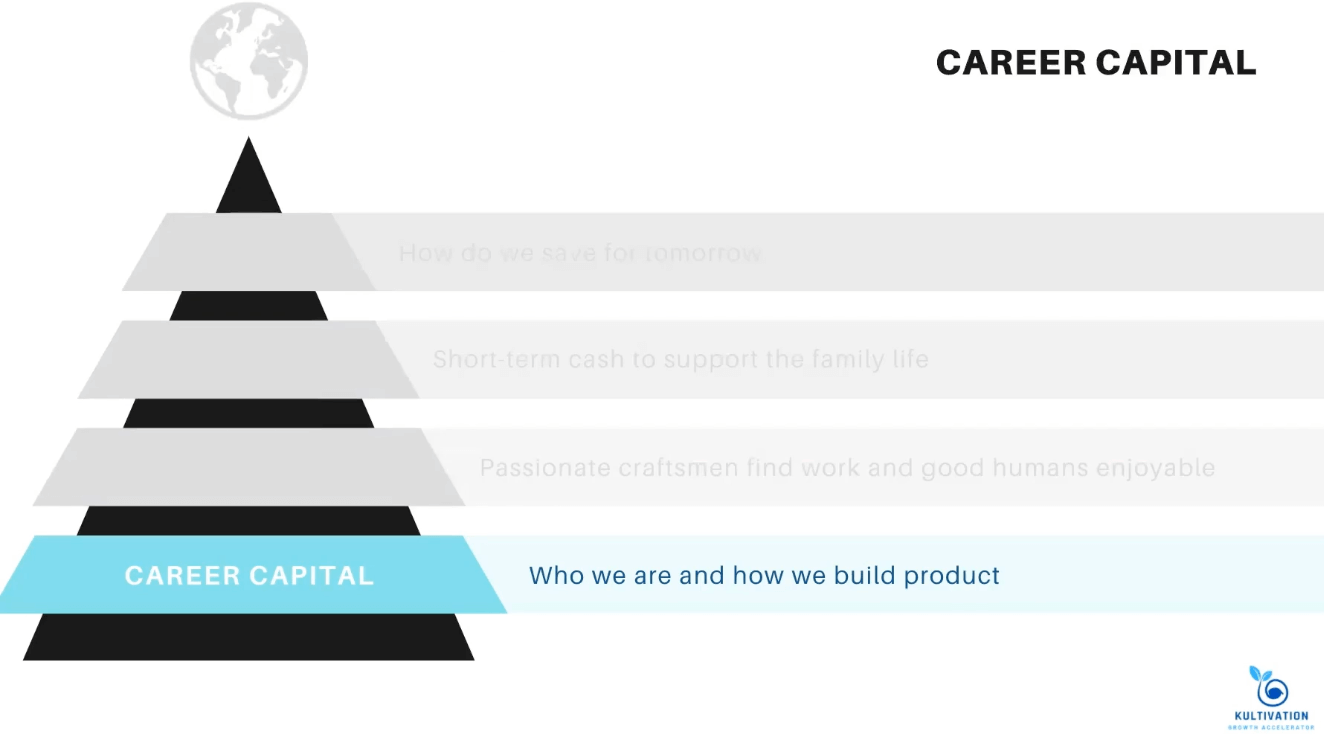

Here are the steps of that framework:

- Career capital: who we are and how we build product

- Fun: passionate craftsmen find work and good humans enjoyable

- Lifestyle: short-term cash to support the family life

- Savings: how do we save for tomorrow

Let’s get started 👇

How to leverage this framework

This pyramid encompasses all the concepts I'll be covering in this article. It's grounded in Maslow's hierarchy of needs because the elements at the foundation of the pyramid are necessary for the rest of the areas of the pyramid to fall into place.

You should use this pyramid as a guide. Think about where you are right now and where you might want to go. This also connects your personal and professional life, which is sometimes hard to figure out what the intersection looks like.

You should take control, manage your career like a product and think about what requirements you have or what gaps you might have.

Career capital

The foundation of the pyramid is focused on career capital. This foundation is what's gonna be supporting the rest of your career.

Carer capital, simply put, is focusing on your craft. Think about your product management craft, how you could be doing it better than anyone else and pick a company that allows you the maximum opportunity to build career capital.

In a more simplified way, think about it as learning how you can be in an environment that allows you to learn as much as possible and continue to build upon that capital.

Learning is a key part of career capital

Learning is twofold: educating yourself and putting it into practice. Educating yourself could be in the form of reading books, blogs, listening to talks, going to conferences, but the true learning is going to happen when you practice. Practice is what is going to make you better.

Practicing within the work environment gives you a great feedback mechanism where you can refine what you've learned and make it better.

Practicing also generates a lot of great stories and examples you can share, either as part of an interview process, put it on your resume, or share it with other people also struggling through their careers.

It's important to find companies that can empower their people to try and obtain better outcomes, not only for the company but for yourself as well. If you're not in an environment where you can try and learn, then that may not be the right place for you to invest in career capital.

As a product manager, you might be new, have been doing product management for a while, or be at that next step in your career where you're trying to get to leadership, but these are areas to focus on for career capital:

- Prioritization mechanisms

- How to build roadmaps

- Making data-driven decisions

- Setting goals

- Creating a culture of collaboration.

- People management (if you're in the leadership realm)

Book recommendations

These books are well known in the product management community. ‘Jobs to be done’ gives a good foundation around a framework and how to align teams across the organization around a common goal and deliver on what the customer need is.

Marty Cagan has been in the product management community for more than 20 years and has a lot of great books.

I would recommend ‘Inspired’ for somebody who's trying to understand what the role of product is and ‘Empowered’ is more for people who are looking at the leadership level as it focuses on the tried and true experience of many different product leaders.

‘Measure what matters’ is great if you're looking for a framework in which to organize around key results.

It's important to also focus on unlearning to evolve yourself and embrace new methodologies. You have to unlearn either bad habits or things that may not work in the current environment in which you're in. It starts with unlearning, then relearning and then hopefully you get to your end goal.

💡 Key takeaways

If you focus on your career capital and on becoming a better than average product manager, you become part of a smaller pool of top talent which offers more stability not only within your current company but also within an up and down market.

In order to attract talent, some companies are offering really high salaries or high titles and it sounds maybe too good to be true. The reality is you need to be careful about evaluating companies as they may not be the right stuff for you.

Be gentle with yourself!

Fun

When you're really good at your craft, you get to do fun jobs and work with smart people who have a shared passion for what you're working on in the end game.

Fun helps you build your career capital

People often think the company needs to manufacture fun like planning events for bonding but the fun should be coming from work, working with smart people and being in a respectful environment of good humans.

Inherently, that's going to help build your career capital. When you're working with smart people on something you’re all passionate about, you're building your career capital almost without knowing it.

💡 Key takeaway

Surround yourself with smart humans and then you'll have fun building your career capital and also building lasting connections for the future.

You’ll meet people along the way in your career that may help you out later on when you're looking for your next opportunity. They'll remember who you are if you're really smart and passionate about what you're doing.

Lifestyle

In lifestyle management where we're going to focus more on how the personal intersects with your professional world. Lifestyle management is your short-term income and how it supports your family (the broadest sense of the term which is all people who rely on your income to survive) lifestyle.

A couple of years, I had been given an opportunity to join a company at a very early stage in an emerging market.

It might have been right for me if I had been at a different point in my life but it wasn't as they were offering me short-term income that wasn't going to support my family very well at all. We would have to make a lot of compromises in order for me to take this job opportunity.

I wasn't going to compromise the livelihood of my family in order to take that opportunity. The negative impact of my worry for my family and how they're being cared for would have come into play a lot more if I had taken this role and it felt like I was worried about that all the time.

You may have to turn down opportunities at certain points in your career, but know that if you're really good, good opportunities will always be coming your way.

I have taken many pay cuts to take on opportunities I thought were right for me, but I never compromised the lifestyle of my family when I made those decisions.

There’s two parts of short-term income: short and long. Short is your base salary and your bonus.

I recommend that you sit down either with your family or without and figure out what that contract looks like with your family and what minimum income you need to maintain a comfortable lifestyle. When you're evaluating offers, that's the minimum of what you expect in short-term cash.

When you are thinking about short-term cash don't fall into the trap of going to companies offering you a lot of short-term cash and nothing else because it may put you in the trap of not building on your career capital.

Look at the company and make sure it's something right for you at the right time in your career.

The real savings will manifest from being an owner and that's where the long-term compensation comes in.

Depending on where you're in your career, you might have joined companies where they give you a ton or some equity and you don't understand what the valuation of it was but you feel like it's worthless because you've never made any money from any of the equity you were given.

The reality of the situation is you need to get better at choosing the right company.

Savings

The main question to ask yourself here is: how do you leverage your income strategy? For example, one company is a services company and the other is a software company.

Services companies typically bill hourly and if the company is making $100 million a year, it's gonna get valued close to that, maybe a little bit more. However for the software company, the software is working for you not just the hours you're working so even if they're making $100 million of revenue a year, they might be valued at 10 to 40x that.

Your challenge is going to be picking the right company so you can see the same type of financial benefit as the example. We've been talking about working with fun teams, smart people, great leadership, which are all important when evaluating the right opportunity for you, but you also need to think like an investor.

Look at what the top 10 investors are investing in. They're not always going to pick a winner but the chances are much higher than somebody who’s not an expert. When you're evaluating your offer, look at the equity but also understand the valuation of that equity.

If you're given 10 shares vs a million shares, don't just take it on faith that a million shares mean more money. By doing this, you’ll have the opportunity to make 40 extra salary in four years.

How are you going to be impacting the greater world?

I want to make the world a better place sounds really cliche. It doesn't have to be fulfilled in the traditional ways you're thinking about.

You could help somebody save time and give this time back to them to do something else or spend time with their family and loved ones. You could be working on something to help improve the environment.

Once you get to a certain level in your career, you can also affect the income for somebody and have it be a steep change in their life.

You can either look at the company and see how they are changing the world and making it a better place and how you can have an impact there or you could also look at yourself and your personal impact. It's important to think about this as part of your career.

To sum up

Pick the right companies that offer the ability to build your career capital, work with smart people and work on interesting problems.

Think about how they're going to compensate you for your short-term needs to maintain the lifestyle your family expects and then also compensate you for the long-term haul (for the savings for tomorrow).

Lastly, contribute to making the world a better place.

Reflect on where you're at and determine if anything needs to change. You need to take control of job stability, actively manage your career and if you're unsure what you should be focusing on at this point in your career, that's where peer groups come into play, mentors, and product management communities.