Natalie Louis gave a great talk on pricing benchmarks at our Future of SaaS Festival.

"We know we're facing unprecedented times right now in this COVID-19 era, and it's causing a lot of uncertainty in our professional and our personal lives.

As a consumer, you're feeling it and as a business, you're feeling it and in both, you're looking for guidance on what to expect and what to do. Given all this uncertainty, people in companies are looking to data and insights to help guide their business decisions."

The new normal

"Zuora, along with many other companies, has been studying the data and helping companies adapt as we begin to reboot to this new normal. PwC noted that objectives and goals are still similar, but how we act on them is going to be different.

Remote working is starting to become the new norm with Twitter and Facebook announcing plans to work remotely, and companies are looking to upskill their workforce, streamline their operations, and be more efficient to go virtual and change how they do business and prepare for this new norm."

Changing pricing strategies to adapt

"Today, we're going to dive into some of that data and the insights and see how companies are taking action on different pricing strategies to adapt. We'll also look at benchmark data and surface best practices and pricing models that you should be applying to your pricing strategies, let's dig into this.

Today we're living in this world of uncertainty and companies are looking at the temporary and permanent impacts of COVID. No one could predict the sudden change in the economic climate. It can happen anywhere to any business at any time as we’ve seen COVID-19 spread throughout the global economy."

The impact of COVID on revenue

"PwC and Gartner have both been surveying and collecting data - PwC has done five different surveys to date with CFOs and in their latest on May 4, it showed the views of over 280 finance leaders and found:

- Over 50% of them expected a decline of 10% or greater in their revenue, and

- Most of them want to fast track changes now to be more agile.

Gartner's surveys showed:

- 85% of the finance leaders expect revenues to be negatively impacted, and

- 40% expected decrease of up to 20%."

The resilience of subscription companies

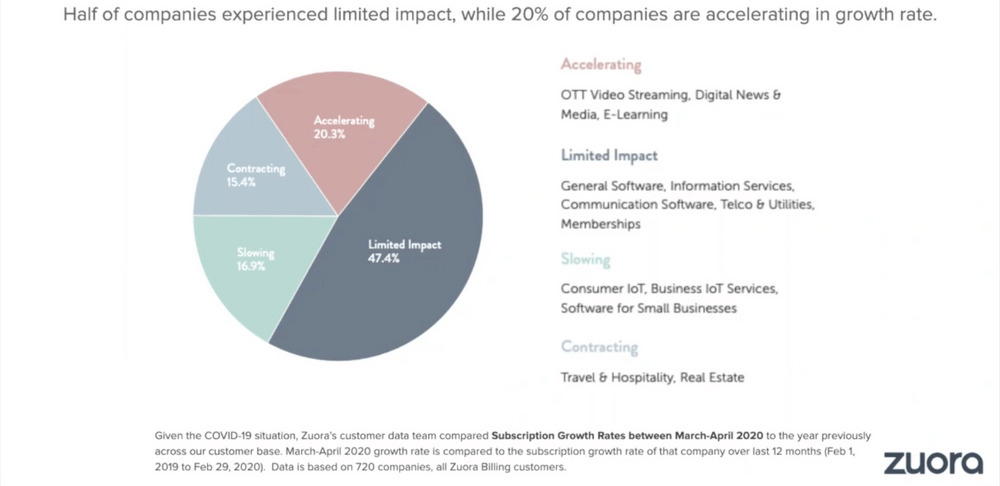

"Given Zuora works with over 1000 businesses, we went and looked at our data. What we found is that, in aggregate, subscription companies are proving to be resilient. We see that subscription businesses with this recurring revenue model are proving their resilience and half of our customer base experienced limited impact with 20% of them actually growing.

If you look at the light green area in the image above 15% are contracting - that's your travel, hospitality, real estate companies giving shelter in place.

Looking at the light blue area, about 16% of them are slowing - they're just not growing as fast as before but they're still growing, those are your consumer IoT, business IoT services, and software for small businesses.

The majority of them, 68%, are faring well, 40% have no impact, another 20% in the red are actually accelerating and growing - these are your video streaming, your digital news, and your e-learning platforms. As everyone's homeschooling and working from home this is what everybody's using now.

On aggregate, subscription companies with this recurring revenue model are proving their resilience and this validates the shift to subscription business models. IDC noted that by 2020 50% of the world's largest enterprises will move to digitally enhanced products, services, and experiences."

The recurring revenue model

"We're seeing companies who wanted to move to this recurring revenue model, who had it on the backburner, now fast-tracking those plans. We also have a Subscribe Institute, this is Zuora's Think Tank arm, and they noted that companies who let customers make changes to their subscription, they grow five times faster than companies that don't.

This is why we're seeing the shift to subscription business models, where SaaS companies benefit from recurring revenue, and especially when they allow their customers to adjust or tailor their contracts where we can tailor and change our pricing and monetization strategies for our customers.

So, let's look at how some of these companies are doing this and allowing their customers to make changes to their subscriptions."

How are companies adapting?

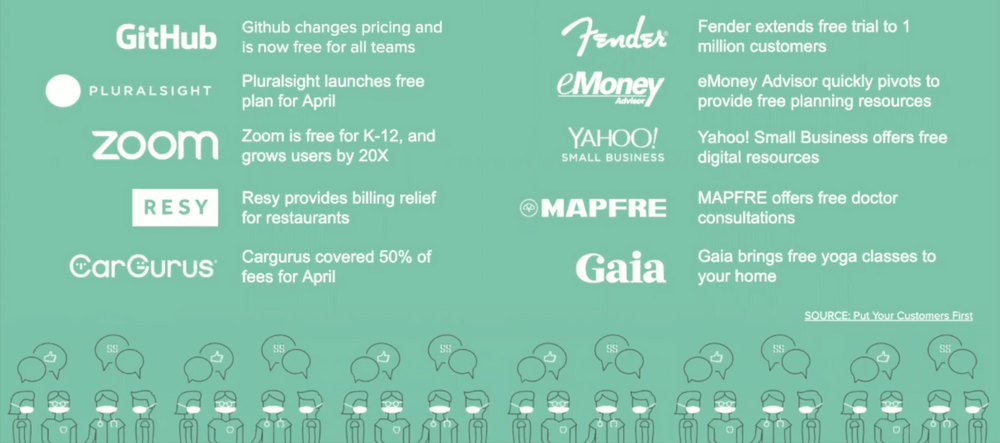

"Companies are using pricing to put their customers first and organizations are taking this time to double down on those relationships - do what's right for customers and society. By doing the right thing, it goes a long way in building customer loyalty and long term relationships so that companies can grow customer lifetime value.

Here's a sample of Zuora’s latest announcements and Press Release articles from our subscribe community, how subscription businesses are using pricing strategies to give back, do what's right for their customers, make an impact, and grow that loyalty, acquisition, and retention of their customers.

You'll notice that many of them are changing their pricing, creating new bundles, offering free trials, and giving payment relief. If you look at Zoom, they're driving adoption now with students and opening up their gates to put customers first.

Fender, they launched a free trial of their guitar lessons, as people are looking for new hobbies, while they shelter in place, and as shelter in place is extended, they keep extending their free trial.

What were some of the most common responses from companies - here's how they did it and the behind the scenes thought process on some of these common responses to COVID-19.

Can your subscribers still access your product?

Companies started by asking, can your subscribers still access your product? If they can't then pause their billing, suspend the subscription, extend their contract. This reduces potential churn.

I'm a member of core power yoga, I can't go to the yoga studio right now, so they paused my billing automatically.

If you look at different travel companies, in-flight Wi-Fi providers are suspending their subscriptions given people can't travel."

Are your subscribers able to pay?

"If they can't then delay payments, give credits or a discount, adjust payment terms. So restaurants are struggling and point of service companies are issuing credit memos for all their customers.

What other benefits can you offer?

Now if your subscribers are able to pay, then what more benefits can they get from your subscription? That's where pricing comes into play, change pricing, offer a free trial, introduce a new bundle, quickly change your pricing strategy. Wwith people sheltering at home, Fender keeps extending their free trial.

As people are working remotely, a developer software company made its team plans free. Now, you're probably thinking that's great for all these companies, but how can I rethink my pricing strategy? Where do I start?"

How can I rethink my pricing strategy?

"Let's start with some of the basics. These are the common types of pricing strategies SaaS companies use when they create their skew structure.

One time prices

You've got one time prices and skews - one-time setup fees or implementation fees that people pay once. B2C companies like gyms or clubs have one-time initiation fees, B2B companies have one-time setup fees.

Recurring prices

Then there are recurring prices. This is the hallmark of a subscription business - it has recurring revenue. B2B and B2C companies have recurring monthly and annual fees. I pay my recurring fee to Amazon and Netflix as a consumer and for work, we pay an annual fee to DocuSign for moving all of our agreements to the cloud.

Usage-based pricing

Then there's usage-based pricing where customers can pay for what they consume. So Uber and Lyft - you pay for a ride when you use it. Airbnb you pay for a stay when you book one. And these are very common in these two or three-sided marketplaces.

If you look at the first two, these are very standard and very common but this last one, usage-based pricing, is actually the least used when you look at B2C and B2B SaaS companies, and it actually provides a huge opportunity for everyone here.

Because usage-based pricing enables faster growth, for your revenues, for your business, and for your customer acquisition. But telling you that isn't enough to make you believe this and before I show you the data to prove it, let's first level set on the definition.

Usage-based pricing: a definition

So usage-based pricing is basically customers pay for what they use. The more they use, the more they pay, the less they use, the less they pay. It's like going to your local fair, you pay for the rides that you go on, if you don't go on the rides, you don't pay for it.

It's very fair and closely related to value-based pricing and given value-based selling and value-based pricing is the Northstar of many SaaS companies, you're probably thinking, "Well, why don't we make all of our pricing usage-based then?"

Can you have too much of a good thing? Can you have too many cherries?

I'm excited it's cherry season here in the Bay Area because my kids love to eat them. And given cherries have natural melatonin in them, eating these at night helps my kids sleep through the night better.

But I also know it has a natural laxative effect. So I'm cautious in allowing my kids to eat too many. The goal here is to strike that right balance, and each evening in our house on our cherry consumption, so our kids are spending more time in their beds than the bathroom.

Just like cherries, usage-based pricing has its own sweet spot.

Usage-based pricing: the data

Let's unpack that data now that I promised. The subscribe institute looked at usage-based pricing data and surface insights. They found that using usage-based pricing increases revenue growth and the sweet spot here is to have 25% of your revenue to come from usage-based pricing.

So if you look at the chart above in the middle, it shows that when you have up to 25% of your revenue come from usage-based pricing, you can maximize your growth potential.

Now on the left, if you don't have any usage-based pricing growth is only 19%. But it's 25% if you've got usage-based pricing.

If you have too much usage-based pricing, your growth starts to go down and so usage-based pricing is like that cherry on top of your recurring revenue cake, just don't cover your cake with more than 25% of those cherries."

Usage-based pricing: B2B vs. B2C

"How about the breakdown between B2B versus B2C companies? Let's break that data down.

B2B companies

First B2B companies - usage-based pricing here is now table stakes for B2B companies in order for them to remain competitive. In the chart, the red and the pink slices of the pie show more than half of B2B companies have usage-based pricing, it's relatively the same as the general data that I just showed you.

If you look at the chart, the middle green bar shows that the sweet spot remains consistent, where 25% of your revenue should come from usage-based pricing.

This is table stakes now, and if your B2B company is not using usage-based pricing, then you will not remain competitive.

B2C companies

Now let's break this down for B2C companies. Usage-based pricing here's actually a differentiator as long as it's done right. In the red and the pink, it shows that only 26% of B2C companies have usage-based pricing.

If you're a B2C company and you do this, this is a big differentiator for you. On the chart in the middle bar, you see that the sweet spot is consistent here too, up to 25% of your revenue should come from usage-based pricing.

B2C companies actually see less benefit to no usage. And there's a downside here when there's heavy usage pricing. If more than 25% of your revenue comes from usage-based pricing, there's definitely no net benefit here.

So for B2C companies, there is evidence of harm of too much usage-based pricing because it can really harm your acquisition rates. Again, this can be a real differentiator if deployed correctly.

Usage-based pricing also helps with upsells and gives companies a 1.5 x boost in increasing your average revenue from your existing customers. So if you look at this chart usage also helps B2B companies with acquiring and upselling your existing customers.

Lastly, usage pricing reduces churn by one fifth across the board, you can see in this chart, any incorporation of usage-based pricing actually helps with churn versus not having any.

So usage helps across churn across all different levels."

"The conclusion here is that both B2B and B2C companies can benefit from having 25% of the revenue come from usage-based pricing."

Usage-based pricing: best practices

"Let's start with the key tenants of usage-based pricing. Usage models require transparency and trust and when it comes to your pricing metric, you want to make sure that the pricing metric you pick ties to value, that it's predictable and trackable and that it's actually clear and familiar because that's what brings value to the customer, and the customer can reasonably control their usage.

Then you've got to have the right systems in place that are timely, clear, and have accurate reporting, so people and customers can see how much they've used. You want to make sure it supports business agility so we can have those different changes and swings in usage, and it allows for customer control.

Some best practices here are that, as we just saw in the data, up to 25% of your revenue should come from usage-based pricing, and ideally, usage can scale up or down as needed by your customers.

In general, the cost per unit should go down with increased usage for the same product that they're getting.

How do you apply this information?

Now that you've got some guidance on key tenants and best practices to think about, how do you apply all of this? Here are some common usage-based pricing models.

Usage-based pricing is becoming more dominant across many different industries. It really started in software, and now it's spread across manufacturing, retail, media, information, and publishing industries.

There isn't this one size fit model for usage-based pricing, and as our data shows, you have to find the right extent of usage-based pricing to maximize your growth.

There's per-unit pricing, also known as pay as you use, and this is a pay per use, it's a per-unit fee billed immediately after each use.

There's tiered and overage pricing - different prices are charged for each tier of usage and then there's potentially overages for any usage above and beyond that.

Then you can have multi-dimensional pricing. This is charging customers based on a variety of different dimensions and attributes unique to your business."

Usage-based pricing models in action

"Let's look at all three of these as I bring an example to each of them and see it in real life.

Per unit pricing

So when we look at per-unit pricing, this is one of the most basic and also the most common type of usage-based pricing, Zoom here uses per-unit pricing based on a price per host, $10 per user, 25 and then 40 per user as you move up their different packages.

Their pricing scales with the number of users you want, with users here being that value metric that customers are realizing from DocuSign.

Tiered and overage pricing

The next example is tiered and overage pricing. So this is price changes depending on the total usage and then you can have overages, which are optional. Customers get the same feature, but based on usage may pay a different price based on the tier that they fall into here at Stackpath.

Overages here are assessed when a customer exceeds that included bandwidth. Now overages here are optional, some people have them some people don't, there can be a penalty, or you can decide how you want to structure it.

How do you deploy this? There are different ways to structure your tiers, your volumes, and your payments.

Multi-dimensional pricing

Let's move on to the last one, multidimensional pricing. This is based on many different usage variables and attributes. So Zipcar, for example, charges renters per hour to rent a car. However, the price depends on dimensions like city and day of the week.

So you can see here if you're in Los Angeles or if you're in Portland, there's going to be a different cost to rent that car. If it's a weekday versus the weekend, it's going to be a different cost.

This is how different companies can bring in different dimensions based on their business use cases into their usage-based pricing."

Ready to change your pricing?

"Do you feel that you're ready to change your pricing and put your customers first? Zuora has many more examples and case studies of how our customers are putting their customers first by applying various pricing strategies to build that customer loyalty and long term relationships to really emerge out of COVID stronger and ready for this new norm. "

This article is adapted from a speech Natalie gave at the Future of SaaS Festival Natalie Louie is the Senior Director of Product Marketing at Zuora.